Banking (Retail & Commercial)

Delivering the Future of Banking Today

Banking Industry Overview

Banks must seek new competitive advantages in response to changes in customer trust, demographics, and demands as well as profit margins reduced by higher capital requirements, compliance costs, lower fee income and stricter regulations

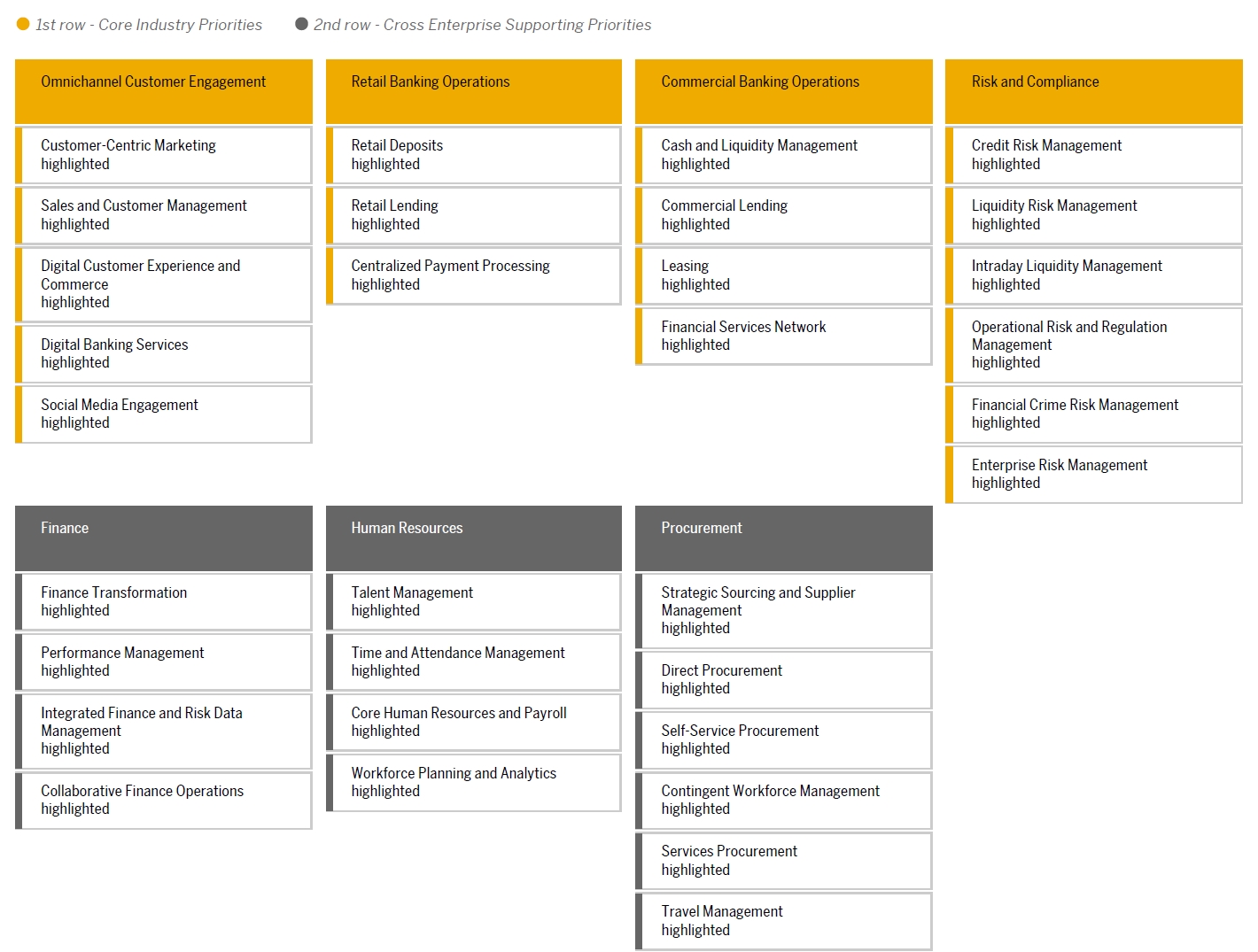

Industry priorities for Retail & Commercial Banking

- Omnichannel customer engagement: Deliver tailored, smooth, and context-aware customer experiences across channels.

- Retail and commercial banking operations: Streamline and automate core banking operations to serve in real time with flexible, agile processes.

- Risk and compliance: Build an integrated view of finance, risk, and compliance while providing real-time insight to stakeholders.

Our Edge

GapBridge offers cutting edge ERP, Analytics, Mobility and Cloud solutions well suited to Banking industry by differentiating customer services, reducing operational cost and complexity, and effectively managing risk and compliance through:-

- Deliver tailored and context-aware experiences and products with customer-centric origination.

- Provide real-time agile and automated servicing of multiple products, bundles, and packages.

- Streamline and automate real-time banking operations with flexible, agile processes.

- Achieve real-time insight for a reconciled view of finance, risk, and compliance.

- Enable digital, customer-centric, real-time banking and financial services.

- Optimize financial processes and provide real-time financial, risk, and operational insights.

- Improved customer acquisition, service, loyalty, restore trust and next-generation customer experience

- Facilitate effective allocation of capital and Enable growth with digital banking