Banking (Retail & Commercial)

Delivering the Future of Banking Today

Banking Industry Overview

Banks must seek new competitive advantages in response to changes in customer trust, demographics, and demands as well as profit margins reduced by higher capital requirements, compliance costs, lower fee income and stricter regulations

Industry priorities for Retail & Commercial Banking

- Omnichannel customer engagement: Deliver tailored, smooth, and context-aware customer experiences across channels.

- Retail and commercial banking operations: Streamline and automate core banking operations to serve in real time with flexible, agile processes.

- Risk and compliance: Build an integrated view of finance, risk, and compliance while providing real-time insight to stakeholders.

Our Edge

GapBridge offers cutting edge ERP, Analytics, Mobility and Cloud solutions well suited to Banking industry by differentiating customer services, reducing operational cost and complexity, and effectively managing risk and compliance through:-

- Deliver tailored and context-aware experiences and products with customer-centric origination.

- Provide real-time agile and automated servicing of multiple products, bundles, and packages.

- Streamline and automate real-time banking operations with flexible, agile processes.

- Achieve real-time insight for a reconciled view of finance, risk, and compliance.

- Enable digital, customer-centric, real-time banking and financial services.

- Optimize financial processes and provide real-time financial, risk, and operational insights.

- Improved customer acquisition, service, loyalty, restore trust and next-generation customer experience

- Facilitate effective allocation of capital and Enable growth with digital banking

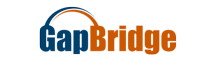

Banking Solution Footprint

Insurance

Becoming a Customer-Centric Insurer

Insurance Industry Overview

The insurance industry is evolving. Customers are informed, demanding, and hyper-connected. Providers need to establish a stronger customer orientation, build deeper relationships with customers, tap into real-time customer and business insights and deliver products to market faster and custom products, and proactively manage risk and compliance.

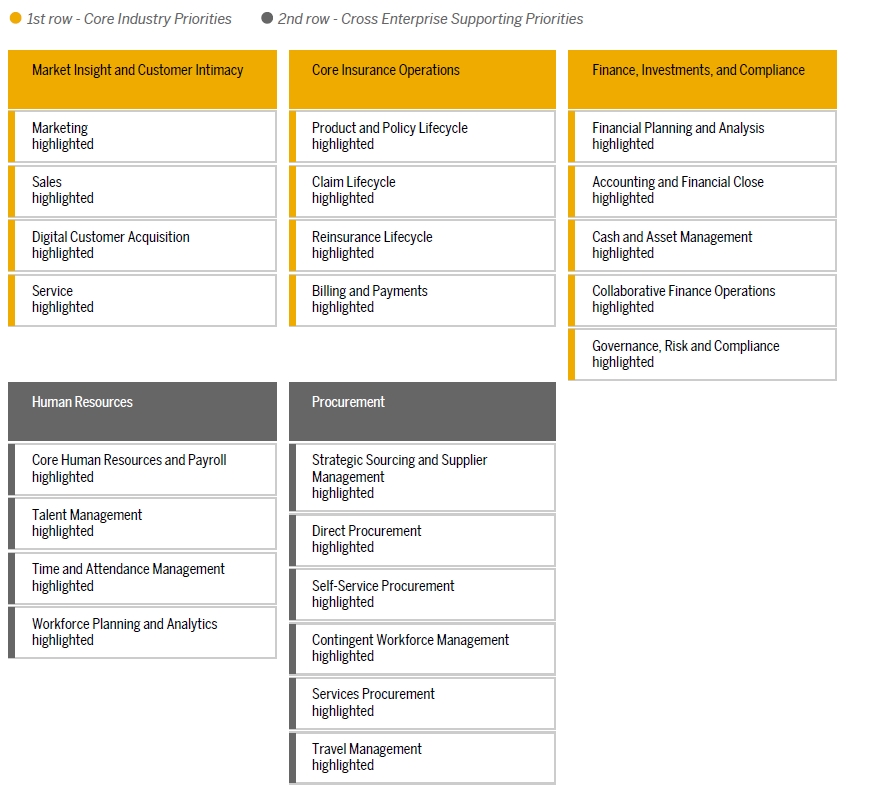

Industry priorities for Insurance

- Market insight and customer intimacy: Create personalized offers that are easy to consume and engage the omnichannel consumer.

- Core insurance operations: Streamline core insurance operations and establish full visibility into risk.

- Finance, investments, and compliance: Create a seamless system that brings together financials, risk management, and compliance

Our Edge

GapBridge offers cutting edge ERP, Analytics, Mobility and Cloud solutions well suited to Insurance industry by simplifying claims management, streamline policy administration, and achieve financial excellence through:-

- Consistent customer experience across multiple channels

- Accelerated response to customer trends and buying habits

- Reduced loss-adjustment expenses from an integrated, complete claims process

- Improved time to market for tailored insurance products

- Increased ability to monitor compliance with industry regulations

- Maximize customer loyalty and retention through innovations of the customer experience.

- Streamline core insurance operations while getting innovative products to market quickly.

- Achieve responsible risk management, balanced investments, and regulatory compliance.

- Enable growth with customer centricity